Trending...

- Vesica Health Receives FDA Breakthrough Device Designation for AssureMDx

- Lt. Governor Primavera Tours U.S. Olympic & Paralympic Museum in Colorado Springs, Highlights Investments to Increase Museum Accessibility

- $38 Million in U.S. Government Contract Awards Secured Through Strategic Partner. Establishing Multi-Year Defense Revenue Platform Through 2032: $BLIS

IQSTEL, Inc. (N A S D A Q: IQST) $IQST Reports Record Q3 2025 Results with $102.8 Million Quarterly Revenue, 42% Sequential Growth and Strengthened Balance Sheet.

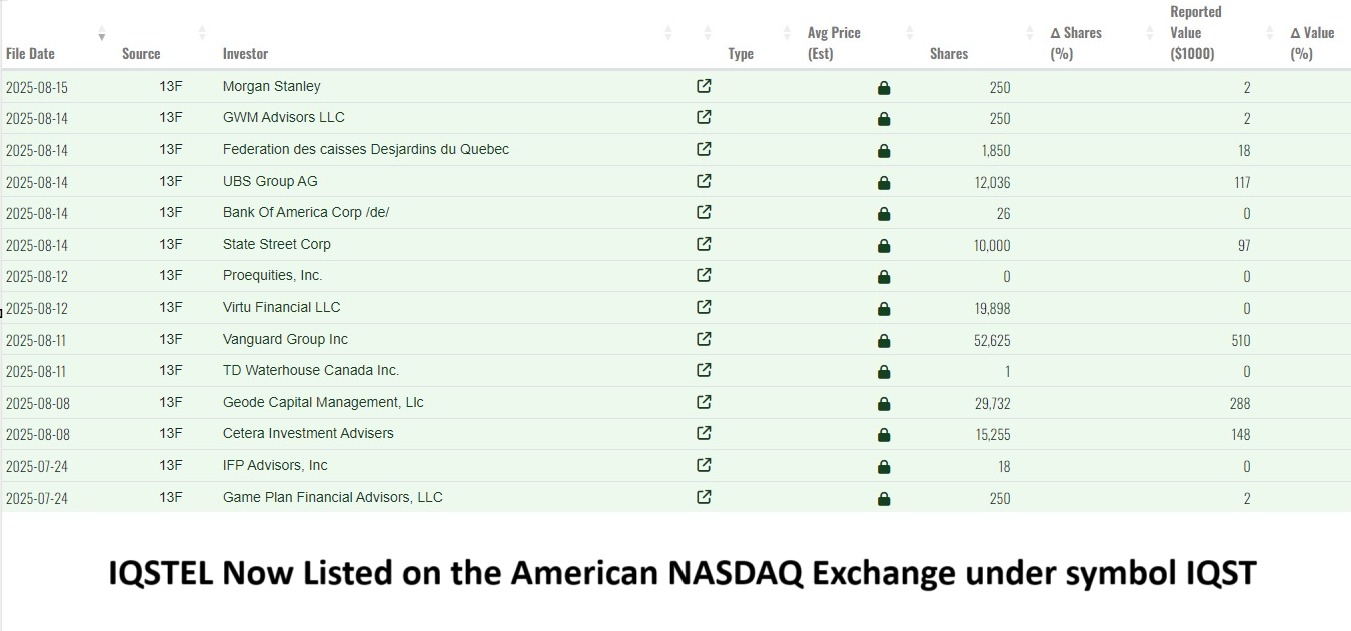

CORAL GABLES, Fla. - ColoradoDesk -- In a year marked by breakneck expansion across telecommunications, fintech, AI, and next-generation cybersecurity, IQSTEL, Inc. (N A S D A Q: IQST) is emerging as one of Nasdaq's most compelling growth stories. With record-setting financial results, a rapidly strengthening balance sheet, major acquisitions already bearing fruit, and the confirmation of a $500,000 dividend payable in free-trading shares, IQSTEL is signaling to the market that its long-term value creation strategy is taking hold—fast.

Investors watching for the next transformative mid-cap technology contender may now be seeing its early inflection point.

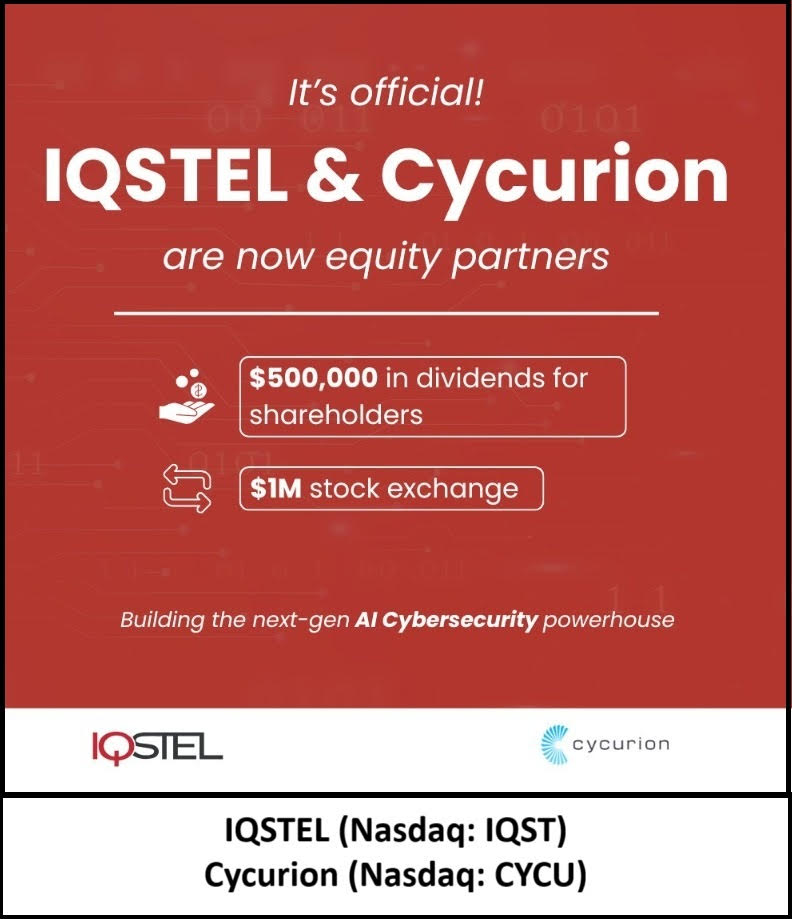

A $500,000 Shareholder Dividend—A Rare Move Among Emerging Tech Firms

On December 3rd, IQSTEL confirmed it will distribute a $500,000 dividend in free-trading IQST common shares. The dividend, calculated at the August 29, 2025 closing price of $6.62, equates to 75,529 shares to be distributed to shareholders of record as of December 15th, with payment on December 30th.

With just 4.37 million shares outstanding, the distribution ratio of 0.0173 per share reflects a meaningful capital return—especially for a debt-free emerging tech company on Nasdaq.

CEO Leandro Iglesias emphasized that this marks the beginning of annual dividends tied directly to performance, stating:

"IQSTEL has fulfilled every promise we made to our shareholders… This $500,000 dividend is a testament to our vision, our execution, and our unwavering dedication to rewarding those who believe in our mission."

In the current market cycle, where investor trust is hard-won, this move could set IQSTEL apart from many of its growth-stage peers.

Record Q3 2025 Results: 42% Sequential Revenue Growth

IQSTEL's financial performance is heating up—rapidly.

More on Colorado Desk

Q3 2025 Revenue: $102.8 million

Up 42% from Q2 and nearly double year-over-year.

The company now reports:

These numbers underscore one of the strongest balance sheets among emerging tech corporations on Nasdaq—particularly for one with global operating reach across 21 countries.

A Debt-Free Nasdaq Company with a Clean Capital Structure

In October, IQSTEL made a strategic leap rarely seen at its stage:

The company eliminated every remaining convertible note and now carries no warrants and no convertible debt.

This resets the company's capitalization to a "clean slate" just as it enters a period of accelerating multi-division growth. For institutional investors wary of dilution risk in small-cap tech, this could be a turning point.

Fintech Expansion Accelerates EBITDA Growth: Globetopper Already Performing

Following its July 1st acquisition of Globetopper, IQSTEL has begun harnessing its powerful international telecom business platform—reaching 600+ global operators—to rapidly scale fintech services.

In Q3 2025 alone:

This division is now a key pillar in IQSTEL's plan to achieve a $15 million EBITDA run rate by 2026.

AI & Cybersecurity: First Phase of Next-Gen Cyber Defense Rolled Out

IQSTEL's AI subsidiary, Reality Border, has completed Phase One of its partnership with Cycurion (N A S D A Q: CYCU)—a U.S. government-certified cybersecurity provider.

Together they are deploying a new breed of AI agents fortified by ARx multi-layer cyber defense, including:

This positions IQSTEL at the nexus of AI-driven telecom solutions and next-generation cyber protection—two sectors increasingly converging.

More on Colorado Desk

Launch of IQ2Call: A Play for a Share of the $750 Billion Global Telecom Market

IQSTEL has rolled out IQ2Call, a vertically integrated AI-powered telecom system that blends:

This expansion positions the company to compete across an addressable market exceeding $750 billion globally.

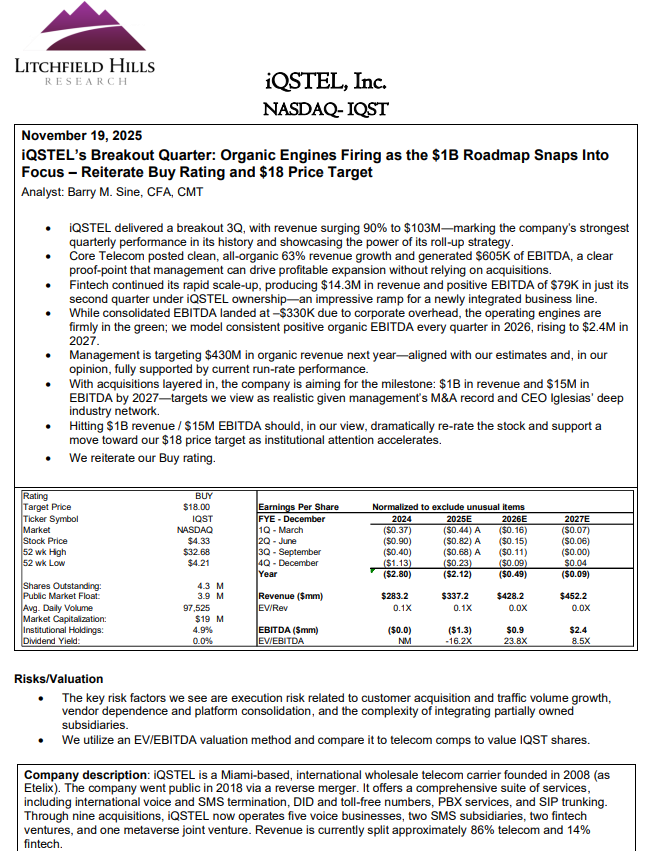

Analyst Coverage: $18 Price Target from Litchfield Hills Research

Litchfield Hills Research recently issued coverage on IQSTEL with a Buy rating and an $18 price target, reflecting confidence in the company's multi-division synergy, strong balance sheet, and aggressive—but measurable—growth milestones.

A Clear Roadmap to $1 Billion Revenue by 2027

IQSTEL projects $340 million in revenue for FY-2025 and sees its path to $1 billion by 2027 supported by:

Given its recent quarterly acceleration, the company's targets—once ambitious—now appear increasingly attainable.

Why Investors Are Paying Close Attention

IQSTEL is entering 2026 with a powerful combination rarely seen among emerging tech companies:

For investors seeking exposure to a diversified, global digital communications and AI company with disciplined capital management and aggressive growth targets, IQSTEL is becoming difficult to ignore.

Investor Resources

Media Contact:

IQSTEL, Inc.

Leandro Jose Iglesias, President & CEO

investors@iqstel.com

+1 954-951-8191

DISCLAIMER: https://corporateads.com/disclaimer/

Disclosure listed on the CorporateAds website

Investors watching for the next transformative mid-cap technology contender may now be seeing its early inflection point.

A $500,000 Shareholder Dividend—A Rare Move Among Emerging Tech Firms

On December 3rd, IQSTEL confirmed it will distribute a $500,000 dividend in free-trading IQST common shares. The dividend, calculated at the August 29, 2025 closing price of $6.62, equates to 75,529 shares to be distributed to shareholders of record as of December 15th, with payment on December 30th.

With just 4.37 million shares outstanding, the distribution ratio of 0.0173 per share reflects a meaningful capital return—especially for a debt-free emerging tech company on Nasdaq.

CEO Leandro Iglesias emphasized that this marks the beginning of annual dividends tied directly to performance, stating:

"IQSTEL has fulfilled every promise we made to our shareholders… This $500,000 dividend is a testament to our vision, our execution, and our unwavering dedication to rewarding those who believe in our mission."

In the current market cycle, where investor trust is hard-won, this move could set IQSTEL apart from many of its growth-stage peers.

Record Q3 2025 Results: 42% Sequential Revenue Growth

IQSTEL's financial performance is heating up—rapidly.

More on Colorado Desk

- At 25, She Became One of the Youngest AAPI Female Founders to Win One of the World's Most Prestigious Design Awards for a Lamp That Makes You Smile

- Juego Studios Extends Full-Cycle Game Development & Outsourcing Capabilities to the UAE Market

- VENUS Goes Live on CATEX Exchange As UK Financial Ltd Activates The Premier Division Of The Maya Meme's League

- Atlanta Tech Founder Seeks Clarity on Intellectual Property and Innovation Policy

- She Speaks CEO Selects Denver as Host City for 2026 National Women in Leadership Conference

Q3 2025 Revenue: $102.8 million

Up 42% from Q2 and nearly double year-over-year.

The company now reports:

- $232.6 million in revenue through the first nine months of 2025

- $411.5 million revenue run rate

- Adjusted EBITDA of $683,189 in Q3

- Assets of $46.8 million ($12.23 per share)

- Stockholders' equity of $17.8 million ($4.66 per share)—a 50% increase from FY-2024

These numbers underscore one of the strongest balance sheets among emerging tech corporations on Nasdaq—particularly for one with global operating reach across 21 countries.

A Debt-Free Nasdaq Company with a Clean Capital Structure

In October, IQSTEL made a strategic leap rarely seen at its stage:

The company eliminated every remaining convertible note and now carries no warrants and no convertible debt.

This resets the company's capitalization to a "clean slate" just as it enters a period of accelerating multi-division growth. For institutional investors wary of dilution risk in small-cap tech, this could be a turning point.

Fintech Expansion Accelerates EBITDA Growth: Globetopper Already Performing

Following its July 1st acquisition of Globetopper, IQSTEL has begun harnessing its powerful international telecom business platform—reaching 600+ global operators—to rapidly scale fintech services.

In Q3 2025 alone:

- Globetopper contributed ~$16 million in revenue

- And delivered $110,000 in EBITDA, making it cash flow positive

This division is now a key pillar in IQSTEL's plan to achieve a $15 million EBITDA run rate by 2026.

AI & Cybersecurity: First Phase of Next-Gen Cyber Defense Rolled Out

IQSTEL's AI subsidiary, Reality Border, has completed Phase One of its partnership with Cycurion (N A S D A Q: CYCU)—a U.S. government-certified cybersecurity provider.

Together they are deploying a new breed of AI agents fortified by ARx multi-layer cyber defense, including:

- Airweb.ai (Web AI agent)

- IQ2Call.ai (Voice AI agent)

- Built on a secure Model Context Protocol (MCP)

This positions IQSTEL at the nexus of AI-driven telecom solutions and next-generation cyber protection—two sectors increasingly converging.

More on Colorado Desk

- Lt. Governor Primavera Tours U.S. Olympic & Paralympic Museum in Colorado Springs, Highlights Investments to Increase Museum Accessibility

- Colorado Springs: 8th Street eastbound frontage road to reopen on Tuesday

- Celebrate Lunar New Year: The Year of the Fire Horse at the Colorado Springs Pioneers Museum

- Colorado Springs: Community Notification of a Sexually Violent Predator

- Colorado: Governor Polis Announces Lieutenant Governor Primavera as Interim Behavioral Health Commissioner

Launch of IQ2Call: A Play for a Share of the $750 Billion Global Telecom Market

IQSTEL has rolled out IQ2Call, a vertically integrated AI-powered telecom system that blends:

- Real-time communications

- AI agents

- Data analytics

- Cybersecurity infrastructure

This expansion positions the company to compete across an addressable market exceeding $750 billion globally.

Analyst Coverage: $18 Price Target from Litchfield Hills Research

Litchfield Hills Research recently issued coverage on IQSTEL with a Buy rating and an $18 price target, reflecting confidence in the company's multi-division synergy, strong balance sheet, and aggressive—but measurable—growth milestones.

A Clear Roadmap to $1 Billion Revenue by 2027

IQSTEL projects $340 million in revenue for FY-2025 and sees its path to $1 billion by 2027 supported by:

- Organic growth across telecom and fintech

- Strategic acquisitions

- Accelerated roll-out of advanced AI and cybersecurity products

- High-margin product expansion using its existing global customer trust

Given its recent quarterly acceleration, the company's targets—once ambitious—now appear increasingly attainable.

Why Investors Are Paying Close Attention

IQSTEL is entering 2026 with a powerful combination rarely seen among emerging tech companies:

- Record revenue momentum

- Strong EBITDA progression

- Zero debt, zero convertibles, zero warrants

- Annual dividend initiation

- Rapid AI and cybersecurity expansion

- New fintech profitability

- One of the strongest balance sheets in its peer group

For investors seeking exposure to a diversified, global digital communications and AI company with disciplined capital management and aggressive growth targets, IQSTEL is becoming difficult to ignore.

Investor Resources

Media Contact:

IQSTEL, Inc.

Leandro Jose Iglesias, President & CEO

investors@iqstel.com

+1 954-951-8191

DISCLAIMER: https://corporateads.com/disclaimer/

Disclosure listed on the CorporateAds website

Source: CorporateAds

Filed Under: Business, Technology

0 Comments

Latest on Colorado Desk

- Lineus Medical's SafeBreak® Vascular Added to Alliant GPO Contract

- Cancun All Inclusive is ready for Spring Break 2026 with new Resorts, Exclusive Deals, activities and more!

- 66% of US Bankruptcies Are Medical — So Americans Are Building Businesses That Cover Healthcare Emergencies

- Ludex Partners With Certified Trading Card Association (CTCA) To Elevate Standards And Innovation In The Trading Card Industry

- Andon Guenther Design Wins Six GDUSA Awards in 2025

- Best Book Publishing Company for Aspiring Authors

- Dr. Nadene Rose Releases Moving Memoir on Faith, Grief, and Divine Presence

- Colorado: Polis Administration Announces Funding to Support Large Building Energy Efficiency and Electrification Measures

- Gigasoft Solves AI's Biggest Charting Code Problem: Hallucinated Property Names

- Colorado Springs: Marksheffel Road closures planned overnight Thursday, Friday, plus during day on Saturday

- Parks, Recreation and Cultural Services hiring seasonal staff to support summer programs across Colorado Springs

- ASTI Ignites the Space Economy: Powering SpaceX's NOVI AI Pathfinder with Breakthrough Solar Technology: Ascent Solar Technologies (N A S D A Q: ASTI)

- Hiring has reached a "Digital Stalemate"—Now, an ex-Google recruiter is giving candidates the answers

- 2026 Pre-Season Testing Confirms a Two-Tier Grid as Energy Management Defines Formula 1's New Era

- Platinum Car Audio LLC Focuses on Customer-Driven Vehicle Audio and Electronics Solutions

- Postmortem Pathology Expands Independent Autopsy Services in Kansas City

- Postmortem Pathology Expands Independent Autopsy Services Across Colorado

- Colorado: Governor Polis Responds to State of the Union: Tariffs Are a Tax on Americans

- $38 Million in U.S. Government Contract Awards Secured Through Strategic Partner. Establishing Multi-Year Defense Revenue Platform Through 2032: $BLIS

- Mecpow M1: A Safe & Affordable Laser Engraver Built for Home DIY Beginners