Trending...

- AutoLab Englewood Auto Repair Warns Drivers After Diesel Fuel Accidentally Enters Gasoline Vehicles Across Englewood Colorado Area

- Acmeware and Avo Partner to Bring Real-Time Data Integration to MEDITECH Customers

- Jones Law Firm Opens New Greenwood Village Office, Expanding Denver Family Law Services

Off The Hook YS Inc. (NYSE American: OTH) $OTH is Projected to Reach $140 to $145 Million in 2026 and is Profiled in New BD Deep Research Report on its Position in $57 Billion US Marine Industry

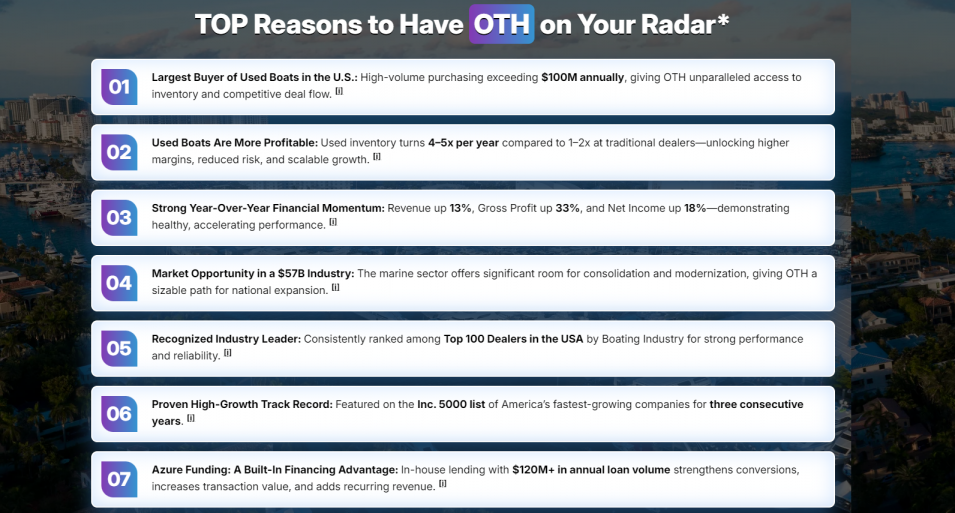

WASHINGTON, N.C. - ColoradoDesk -- Off The Hook YS Inc. (NYSE American: OTH) is quietly transforming the fragmented pre-owned boat market into a data-driven, institutional-grade platform—and investors are beginning to take notice.

Following its November IPO, the company reported record nine-month revenue of $82.6 million, up 19.3% year over year, alongside accelerating unit growth, expanding margins, and a powerful demand catalyst stemming from newly reinstated 100% bonus depreciation for qualifying boat purchases.

With 2026 revenue guidance of $140–$145 million, OTH is positioning itself as one of the most compelling small-cap growth stories in the U.S. marine industry.

A Market Leader in a Massive, Underserved Industry

Founded in 2012 by President Jason Ruegg, Off The Hook YS has grown into one of America's largest buyers and sellers of pre-owned boats, acquiring more than $100 million in boats and yachts annually. The company operates a nationwide network of offices and marinas across multiple states, offering brokerage, wholesale, and performance yacht sales.

The opportunity is significant. The U.S. marine industry is valued at approximately $57 billion, with continued growth driven by recreation, luxury demand, and business-use vessels. In parallel, the U.S. ship repair and maintenance services market, valued at $6.55 billion in 2025, is projected to reach $11.72 billion by 2033, highlighting durable long-term tailwinds.

OTH has consistently earned recognition on the Inc. 500 and has been ranked among the Top 100 Boat Dealers in the United States, underscoring its operational credibility and scale.

Technology as a Competitive Moat

What differentiates OTH from traditional boat dealers is its AI-assisted valuation tools and data-driven sales platform, which bring speed, transparency, and liquidity to a historically opaque market.

More on Colorado Desk

By leveraging proprietary data and analytics, OTH accelerates transaction cycles, improves pricing accuracy, and enhances inventory turnover—creating what some analysts describe as a form of structural arbitrage in marine liquidity.

This digital transformation thesis is explored in depth in a newly released BD Deep Investor Research Report, titled:

"Off-The-Hook YS: Digital Transformation and Margin Inflection in the Marine Industry – Structural Arbitrage in the Marine Liquidity Market."

Financial Momentum Continues Post-IPO

On December 15, OTH reported results for the third quarter ended September 30, 2025, marking its first earnings update following its IPO.

Third Quarter 2025 Highlights

Nine-Month 2025 Highlights

Importantly, unit growth continues to outpace revenue growth—an indicator of improving market penetration and long-term operating leverage.

A Powerful Tax Catalyst: 100% Bonus Depreciation

In July 2025, the "One Big Beautiful Bill Act" reinstated 100% bonus depreciation for qualifying business assets, including boats and yachts, through January 19, 2026.

For eligible buyers using vessels more than 50% for legitimate business purposes, this incentive allows the entire purchase price to be deducted in year one—dramatically improving after-tax economics.

More on Colorado Desk

"This incentive is a game-changer," said Ruegg. "A buyer who meets the IRS requirements can deduct the entire cost of the boat in year one. This has already boosted demand, and we expect interest to surge even further."

As the national leader in pre-owned boat inventory, OTH is uniquely positioned to capitalize on this demand surge, offering one of the broadest all-brand selections in the country—a key advantage over competitors with limited inventories.

Expansion Into Luxury Brokerage

To further strengthen its presence in high-value transactions, OTH recently announced the development of a new Jupiter, Florida office, which will serve as headquarters for Autograph Yacht Group (AYG), its luxury brokerage division led by industry veteran Mike Burke.

The facility includes office space and six on-site boat slips, providing direct inventory access in one of the most active yachting markets in the U.S. The build-out is expected to be completed in early 2026.

Clear Line of Sight to 2026 Growth

Management has issued full-year 2026 revenue guidance of $140–$145 million, reflecting confidence in continued demand, expanding broker productivity, tax-driven buying activity, and platform scalability.

With:

Off The Hook YS Inc. is emerging as a next-generation consolidator and liquidity leader in the U.S. marine market.

Investor Resources

Ticker: NYSE American: OTH

DISCLAIMER: https://corporateads.com/disclaimer/

Disclosure listed on the CorporateAds website

Following its November IPO, the company reported record nine-month revenue of $82.6 million, up 19.3% year over year, alongside accelerating unit growth, expanding margins, and a powerful demand catalyst stemming from newly reinstated 100% bonus depreciation for qualifying boat purchases.

With 2026 revenue guidance of $140–$145 million, OTH is positioning itself as one of the most compelling small-cap growth stories in the U.S. marine industry.

A Market Leader in a Massive, Underserved Industry

Founded in 2012 by President Jason Ruegg, Off The Hook YS has grown into one of America's largest buyers and sellers of pre-owned boats, acquiring more than $100 million in boats and yachts annually. The company operates a nationwide network of offices and marinas across multiple states, offering brokerage, wholesale, and performance yacht sales.

The opportunity is significant. The U.S. marine industry is valued at approximately $57 billion, with continued growth driven by recreation, luxury demand, and business-use vessels. In parallel, the U.S. ship repair and maintenance services market, valued at $6.55 billion in 2025, is projected to reach $11.72 billion by 2033, highlighting durable long-term tailwinds.

OTH has consistently earned recognition on the Inc. 500 and has been ranked among the Top 100 Boat Dealers in the United States, underscoring its operational credibility and scale.

Technology as a Competitive Moat

What differentiates OTH from traditional boat dealers is its AI-assisted valuation tools and data-driven sales platform, which bring speed, transparency, and liquidity to a historically opaque market.

More on Colorado Desk

- City of Colorado Springs' Chief of Staff Jamie Fabos announces departure

- City of Colorado Springs earns 2026 Silver Military Friendly® Employer, Military Friendly® Spouse Employer designation

- Sharpe Automotive Redefines Local Car Care with "Transparency-First" Service Model in Santee

- Paribury Exchange Updates Information Disclosure and User Communication Framework

- Colorado: Governor Polis Delivers 2026 and Final State of the State Address: The State of Our State is Strong, Resilient, Kind, Innovative, and Free

By leveraging proprietary data and analytics, OTH accelerates transaction cycles, improves pricing accuracy, and enhances inventory turnover—creating what some analysts describe as a form of structural arbitrage in marine liquidity.

This digital transformation thesis is explored in depth in a newly released BD Deep Investor Research Report, titled:

"Off-The-Hook YS: Digital Transformation and Margin Inflection in the Marine Industry – Structural Arbitrage in the Marine Liquidity Market."

Financial Momentum Continues Post-IPO

On December 15, OTH reported results for the third quarter ended September 30, 2025, marking its first earnings update following its IPO.

Third Quarter 2025 Highlights

- Revenue of $24.0 million

- 112 boats sold, up 51% year over year

- Second-highest quarterly unit volume in company history

- Gross profit of $3.0 million

- Adjusted EBITDA of $0.5 million

- Net loss narrowed to $0.07 million

- Launch of Autograph Yacht Group, a luxury brokerage division

- Addition of 10 new brokers

Nine-Month 2025 Highlights

- Record revenue of $82.6 million, up 19.3%

- 310 boats sold, up 24.4%

- Net income of $0.8 million

- Gross profit of $8.4 million, up $1.5 million year over year

- Adjusted EBITDA of $2.6 million

Importantly, unit growth continues to outpace revenue growth—an indicator of improving market penetration and long-term operating leverage.

A Powerful Tax Catalyst: 100% Bonus Depreciation

In July 2025, the "One Big Beautiful Bill Act" reinstated 100% bonus depreciation for qualifying business assets, including boats and yachts, through January 19, 2026.

For eligible buyers using vessels more than 50% for legitimate business purposes, this incentive allows the entire purchase price to be deducted in year one—dramatically improving after-tax economics.

More on Colorado Desk

- Contract Sewing Lafayette CO | Custom Cut & Sew Manufacturing

- Secondesk Launches Powerful AI Tutor That Speaks 20+ Languages

- Automation, innovation in healthcare processes featured at international conference in Atlanta

- How to use a QR Code scanner from Image: Step-by-Step Guide

- A High-Velocity Growth Story Emerges in Marine and Luxury Markets

"This incentive is a game-changer," said Ruegg. "A buyer who meets the IRS requirements can deduct the entire cost of the boat in year one. This has already boosted demand, and we expect interest to surge even further."

As the national leader in pre-owned boat inventory, OTH is uniquely positioned to capitalize on this demand surge, offering one of the broadest all-brand selections in the country—a key advantage over competitors with limited inventories.

Expansion Into Luxury Brokerage

To further strengthen its presence in high-value transactions, OTH recently announced the development of a new Jupiter, Florida office, which will serve as headquarters for Autograph Yacht Group (AYG), its luxury brokerage division led by industry veteran Mike Burke.

The facility includes office space and six on-site boat slips, providing direct inventory access in one of the most active yachting markets in the U.S. The build-out is expected to be completed in early 2026.

Clear Line of Sight to 2026 Growth

Management has issued full-year 2026 revenue guidance of $140–$145 million, reflecting confidence in continued demand, expanding broker productivity, tax-driven buying activity, and platform scalability.

With:

- Record revenues

- Rapid unit growth

- A national footprint

- AI-enabled operations

- A rare tax incentive tailwind

- And participation in a multi-decade growth industry

Off The Hook YS Inc. is emerging as a next-generation consolidator and liquidity leader in the U.S. marine market.

Investor Resources

- BD Deep Investor Research Report (Dec. 8, 2025):

Off-The-Hook YS: Digital Transformation and Margin Inflection in the Marine Industry

👉 https://www.digitalbdinc.com/report/othdeepresearch12-8-25.pdf - Company Website: www.offthehookyachts.com

- Investor Media: https://compasslivemedia.com/oth/

- Contact: Abigail Lafferty

Email: abigail@pantelidespr.com

Phone: (561) 374-0513

Ticker: NYSE American: OTH

DISCLAIMER: https://corporateads.com/disclaimer/

Disclosure listed on the CorporateAds website

Source: CorporateAds

0 Comments

Latest on Colorado Desk

- Maurer Painting Enhances Interior Painting Experience for Boulder Homeowners

- Simpson and Reed Co-Founders Shardé Simpson, Esq. and Ciara Reed, Esq. Launch "Hello Wilma,"

- Report Outlines Key Questions for Individuals Exploring Anxiety Treatment Options in Toronto

- Governor Polis Celebrates Investments into Pikes Peak Outdoor Recreation Alliance; Protecting and Improving Colorado's Outdoor Economy

- New Wisdom Works report reveals how leaders sustain effectiveness and results under pressure

- Rande Vick Introduces Radical Value, Challenging How Brands Measure Long-Term Value

- ZeroDown Software Forms SafeHouse Resilience Panel to Advance Application-First Resilience

- City report highlights maintenance and trail connectivity as top parks priorities for Colorado Springs residents

- Lisa Mauretti Launches Peace of Mind Travel Coaching to Guide Fearful Travelers to Discover the World with Confidence

- New Year, New Home: Begin 2026 at Heritage at South Brunswick

- Food Journal Magazine Releases Its 'Best Food In Los Angeles Dining' Editorial Section

- Enders Capital: 25% Gains with Just -0.80% Maximum Monthly Drawdown in Volatile Debut Year 2025

- Colorado Springs: Mayor Yemi joins Mayor Mike Johnston and Mayor Mike Coffman in sharing legislative priorities with state leaders

- CES Spotlight Highlights Need for Strategic Review as Throughput Demands Evolve

- ASR Media, Social T Marketing & PR Announce Merger

- $780,000 Project for New Middle East Police Service with Deposit Received and Preliminary Design Work Underway for Lamperd: Stock Symbol: LLLI

- April D. Jones Recognized for Leadership and Contributions to Colorado Family Law

- The 3rd Annual Newark Summit for Real Estate, Economic Development & Placemaking Returns February 9th

- Ski Safety Awareness Month highlights why seeing clearly and wearing modern protection matters more than ever

- Vent Pros Expands Operations into Arizona to Meet Growing Demand for Commercial Ventilation and Kitchen Hood Cleaning Services