Trending...

- Vesica Health Receives FDA Breakthrough Device Designation for AssureMDx

- Lt. Governor Primavera Tours U.S. Olympic & Paralympic Museum in Colorado Springs, Highlights Investments to Increase Museum Accessibility

- $38 Million in U.S. Government Contract Awards Secured Through Strategic Partner. Establishing Multi-Year Defense Revenue Platform Through 2032: $BLIS

Off The Hook YS Inc. (N Y S E American: OTH): Digital BD Deep Releases Comprehensive Research Report as OTH Prepares for December 15 Earnings Call

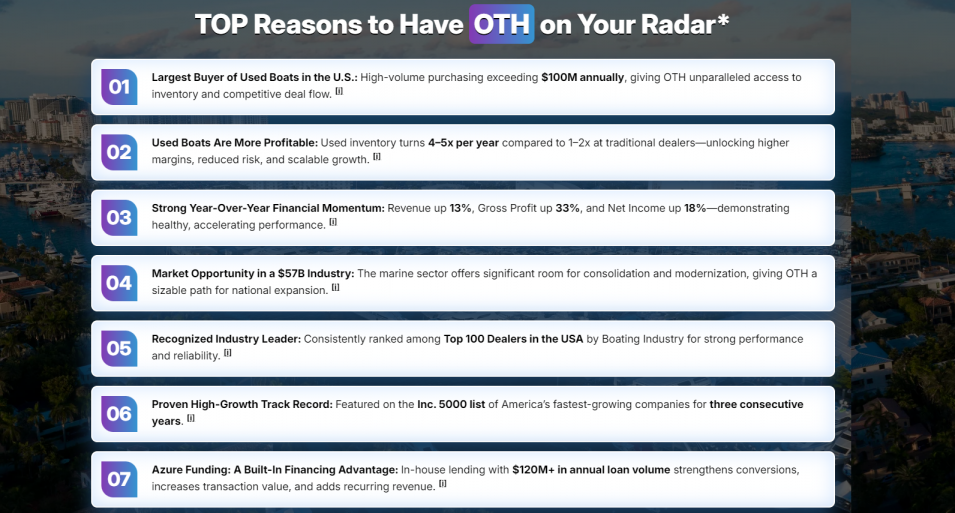

WASHINGTON, N.C. - ColoradoDesk -- Off The Hook YS Inc. (N Y S E American: OTH), one of America's largest buyers and sellers of pre-owned boats, is heading into year-end 2025 with accelerating momentum across its core business, a successful IPO behind it, and major new growth initiatives underway. With operations spanning the East Coast and South Florida, OTH acquires more than $100 million in boats and yachts each year and continues to scale its technology-driven platform to serve a U.S. marine industry valued at $57 billion.

Comprehensive New Research Coverage

On December 8, 2025, Digital BD Deep released an in-depth investor research report titled:

Off-The-Hook YS Digital Transformation and Margin Inflection in the Marine Industry – Structural Arbitrage in the Marine Liquidity Market.

The report profiles OTH's national presence, its role in the marine liquidity ecosystem, and its strategic expansion into luxury brokerage under the newly launched Autograph Yacht Group (AYG). It highlights OTH's growth initiatives, technology adoption, and positioning within a marine sector that remains highly fragmented and ripe for consolidation.

Upcoming Q3 Earnings Release and Conference Call

Investors will receive fresh insight into the company's financial performance when OTH reports its Q3 2025 results on Monday, December 15, 2025, after market close.

A live conference call will follow at 4:30 p.m. ET.

A webcast and replay will be available through the Investor Relations page on the OTH website.

Industry Tailwinds: 100% Bonus Depreciation Returns

More on Colorado Desk

On December 1, the company reminded buyers of a powerful tax incentive now driving demand across the marine market. The "One Big Beautiful Bill Act" (OBBBA), signed into law in July 2025, reinstated 100% bonus depreciation on qualifying business assets—including boats and yachts—through January 19, 2026.

Eligible buyers who use a vessel for more than 50% business purposes can deduct the full purchase price in year one, a catalyst that OTH believes will stimulate significant year-end and early-2026 activity.

"This incentive is a game-changer for anyone considering a boat purchase," said Jason Ruegg, Founder and President of OTH. "Our expanding brokerage team has already helped countless business owners identify qualifying vessels, and we expect demand to surge further."

Given its broad, all-brand inventory and national footprint, OTH is positioned to capture outsized benefit from this tax-driven buying window.

Expansion Into Luxury Brokerage: New Jupiter, Florida Headquarters

On November 25, OTH confirmed the development of a new office in Jupiter, Florida, which will serve as the headquarters for its luxury brokerage division, the Autograph Yacht Group (AYG). Led by industry veteran Mike Burke, AYG targets the high-end yacht market—a segment where Florida remains the nation's strongest hub.

The new location includes modern office space and six on-site slips for premium inventory. Build-out is underway, with completion expected in early 2026.

"The Jupiter location enhances our presence in one of the world's premier yachting markets," said Brian S. John, CEO of OTH. "It will serve both our leadership team and our expanding luxury brokerage division."

Successful IPO Supports Growth and Market Reach

On November 14, OTH completed its initial public offering of 3,750,000 shares at $4.00 per share, generating $15 million in gross proceeds. The company granted underwriters an additional 45-day option to purchase up to 562,500 shares to cover over-allotments.

More on Colorado Desk

Proceeds will be used to:

ThinkEquity acted as sole book-running manager for the offering.

Harnessing Technology and Data in a Traditionally Fragmented Market

Founded in 2012 by Jason Ruegg and headquartered in Wilmington, North Carolina, OTH leverages AI-assisted valuation tools and a data-driven sales platform to streamline yacht transactions—a process historically known for opacity and slow negotiation cycles.

The company's multi-state network of offices and marinas supports brokerage, wholesale, and performance yacht sales, giving buyers and sellers access to one of the nation's broadest pre-owned inventories.

OTH has earned repeated recognition on the Inc. 500 and ranks among the Top 100 Dealers in the United States, reflecting both rapid growth and operational excellence.

Growth Outlook Beyond 2025

In addition to the $57 billion U.S. marine industry, OTH is positioned to benefit from adjacent markets. The U.S. Ship Repair and Maintenance Services Market, valued at $6.55 billion in 2025, is projected to nearly double to $11.72 billion by 2033 (7.52% CAGR). This long-term expansion provides a favorable backdrop for OTH's evolving service offerings and national footprint.

About Off The Hook YS Inc. (OTH)

Off The Hook YS Inc. (NYSE American: OTH) is a leading buyer and seller of pre-owned boats in the United States. Through a nationwide network of marinas and offices, advanced valuation technology, and a fast-growing luxury brokerage division, OTH provides comprehensive solutions for buyers, sellers, and partners across the marine industry.

For More Information

Company: Off The Hook YS Inc. (N Y S E American: OTH)

Contact: Abigail Lafferty

Email: abigail@pantelidespr.com

Phone: (561) 374-0513

Website: offthehookyachts.com | compasslivemedia.com/oth

DISCLAIMER: https://corporateads.com/disclaimer/

Disclosure listed on the CorporateAds website

Comprehensive New Research Coverage

On December 8, 2025, Digital BD Deep released an in-depth investor research report titled:

Off-The-Hook YS Digital Transformation and Margin Inflection in the Marine Industry – Structural Arbitrage in the Marine Liquidity Market.

The report profiles OTH's national presence, its role in the marine liquidity ecosystem, and its strategic expansion into luxury brokerage under the newly launched Autograph Yacht Group (AYG). It highlights OTH's growth initiatives, technology adoption, and positioning within a marine sector that remains highly fragmented and ripe for consolidation.

Upcoming Q3 Earnings Release and Conference Call

Investors will receive fresh insight into the company's financial performance when OTH reports its Q3 2025 results on Monday, December 15, 2025, after market close.

A live conference call will follow at 4:30 p.m. ET.

- Domestic Dial-In: (800) 715-9871

- International Dial-In: (646) 307-1963

- Passcode: 5863262

A webcast and replay will be available through the Investor Relations page on the OTH website.

Industry Tailwinds: 100% Bonus Depreciation Returns

More on Colorado Desk

- NaturismRE Launches the NRE Health Institute to Advance Evidence-Informed Public Health Research

- P-Wave Classics to publish Robert Bage's Hermsprong in three volumes, beginning 12 May

- Colorado: Governor Polis Announces Cabinet Update

- Progressive Dental & The Closing Institute Partner with Zest Dental Solutions to Elevate Full-Arch Growth and Patient Outcomes

- CCHR: While Damaging Antipsychotics Win Approval, Proven Non-Drug Alternatives Remain Ignored

On December 1, the company reminded buyers of a powerful tax incentive now driving demand across the marine market. The "One Big Beautiful Bill Act" (OBBBA), signed into law in July 2025, reinstated 100% bonus depreciation on qualifying business assets—including boats and yachts—through January 19, 2026.

Eligible buyers who use a vessel for more than 50% business purposes can deduct the full purchase price in year one, a catalyst that OTH believes will stimulate significant year-end and early-2026 activity.

"This incentive is a game-changer for anyone considering a boat purchase," said Jason Ruegg, Founder and President of OTH. "Our expanding brokerage team has already helped countless business owners identify qualifying vessels, and we expect demand to surge further."

Given its broad, all-brand inventory and national footprint, OTH is positioned to capture outsized benefit from this tax-driven buying window.

Expansion Into Luxury Brokerage: New Jupiter, Florida Headquarters

On November 25, OTH confirmed the development of a new office in Jupiter, Florida, which will serve as the headquarters for its luxury brokerage division, the Autograph Yacht Group (AYG). Led by industry veteran Mike Burke, AYG targets the high-end yacht market—a segment where Florida remains the nation's strongest hub.

The new location includes modern office space and six on-site slips for premium inventory. Build-out is underway, with completion expected in early 2026.

"The Jupiter location enhances our presence in one of the world's premier yachting markets," said Brian S. John, CEO of OTH. "It will serve both our leadership team and our expanding luxury brokerage division."

Successful IPO Supports Growth and Market Reach

On November 14, OTH completed its initial public offering of 3,750,000 shares at $4.00 per share, generating $15 million in gross proceeds. The company granted underwriters an additional 45-day option to purchase up to 562,500 shares to cover over-allotments.

More on Colorado Desk

- Arcuri Group Announces Long‑Term Partnership with WakeMed Health & Hospitals to Deliver Situational Awareness and De‑escalation Training

- At 25, She Became One of the Youngest AAPI Female Founders to Win One of the World's Most Prestigious Design Awards for a Lamp That Makes You Smile

- Juego Studios Extends Full-Cycle Game Development & Outsourcing Capabilities to the UAE Market

- VENUS Goes Live on CATEX Exchange As UK Financial Ltd Activates The Premier Division Of The Maya Meme's League

- Atlanta Tech Founder Seeks Clarity on Intellectual Property and Innovation Policy

Proceeds will be used to:

- Support floorplan financing

- Expand marketing and advertising

- Repay a promissory note

- Strengthen working capital

ThinkEquity acted as sole book-running manager for the offering.

Harnessing Technology and Data in a Traditionally Fragmented Market

Founded in 2012 by Jason Ruegg and headquartered in Wilmington, North Carolina, OTH leverages AI-assisted valuation tools and a data-driven sales platform to streamline yacht transactions—a process historically known for opacity and slow negotiation cycles.

The company's multi-state network of offices and marinas supports brokerage, wholesale, and performance yacht sales, giving buyers and sellers access to one of the nation's broadest pre-owned inventories.

OTH has earned repeated recognition on the Inc. 500 and ranks among the Top 100 Dealers in the United States, reflecting both rapid growth and operational excellence.

Growth Outlook Beyond 2025

In addition to the $57 billion U.S. marine industry, OTH is positioned to benefit from adjacent markets. The U.S. Ship Repair and Maintenance Services Market, valued at $6.55 billion in 2025, is projected to nearly double to $11.72 billion by 2033 (7.52% CAGR). This long-term expansion provides a favorable backdrop for OTH's evolving service offerings and national footprint.

About Off The Hook YS Inc. (OTH)

Off The Hook YS Inc. (NYSE American: OTH) is a leading buyer and seller of pre-owned boats in the United States. Through a nationwide network of marinas and offices, advanced valuation technology, and a fast-growing luxury brokerage division, OTH provides comprehensive solutions for buyers, sellers, and partners across the marine industry.

For More Information

Company: Off The Hook YS Inc. (N Y S E American: OTH)

Contact: Abigail Lafferty

Email: abigail@pantelidespr.com

Phone: (561) 374-0513

Website: offthehookyachts.com | compasslivemedia.com/oth

DISCLAIMER: https://corporateads.com/disclaimer/

Disclosure listed on the CorporateAds website

Source: CorporateAds

Filed Under: Business

0 Comments

Latest on Colorado Desk

- Talentica Announces Winners of Multi-Agent Hackathon 2026

- Colorado: Governor Polis Memorializes Verbal Disaster Declaration for Highly Pathogenic Avian Influenza in Weld County

- Colorado: Department of Local Affairs Announces Inaugural Transit Oriented Communities Infrastructure Grant Awards

- Special Alert: Undervalued Opportunity: IQSTEL (N A S D A Q: IQST) Positioned for Explosive Multi-Year Growth

- Triple-Digit Growth, Strategic N A S D A Q Uplist, Plus A Scalable Healthcare Rollout Model: Stock Symbol: CDIX

- Vesica Health Receives FDA Breakthrough Device Designation for AssureMDx

- Lineus Medical's SafeBreak® Vascular Added to Alliant GPO Contract

- Cancun All Inclusive is ready for Spring Break 2026 with new Resorts, Exclusive Deals, activities and more!

- 66% of US Bankruptcies Are Medical — So Americans Are Building Businesses That Cover Healthcare Emergencies

- Ludex Partners With Certified Trading Card Association (CTCA) To Elevate Standards And Innovation In The Trading Card Industry

- Andon Guenther Design Wins Six GDUSA Awards in 2025

- Best Book Publishing Company for Aspiring Authors

- Dr. Nadene Rose Releases Moving Memoir on Faith, Grief, and Divine Presence

- Colorado: Polis Administration Announces Funding to Support Large Building Energy Efficiency and Electrification Measures

- Gigasoft Solves AI's Biggest Charting Code Problem: Hallucinated Property Names

- Colorado Springs: Marksheffel Road closures planned overnight Thursday, Friday, plus during day on Saturday

- Parks, Recreation and Cultural Services hiring seasonal staff to support summer programs across Colorado Springs

- ASTI Ignites the Space Economy: Powering SpaceX's NOVI AI Pathfinder with Breakthrough Solar Technology: Ascent Solar Technologies (N A S D A Q: ASTI)

- Hiring has reached a "Digital Stalemate"—Now, an ex-Google recruiter is giving candidates the answers

- 2026 Pre-Season Testing Confirms a Two-Tier Grid as Energy Management Defines Formula 1's New Era